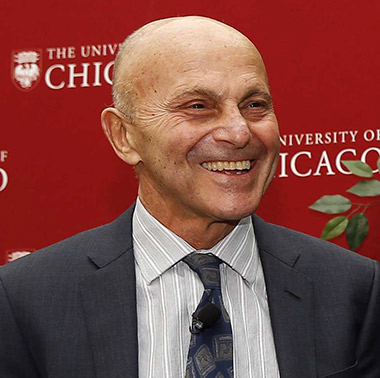

Eugene F Fama Biography

Eugene Fama is an American Nobel laureate in Economics. He is famous for his work on portfolio theory, stock market behavior, and asset pricing. He is the professor at the University Of Chicago Booth School Of Business. He was awarded Nobel Memorial Prize in Economic Services with Lars Peter Hansen and Robert Shiller in 2013. He holds American nationality.

EARLY YEARS & EDUCATION

Eugene was born on February 14, 1939, in Boston, Massachusetts, United States. His birth name is Eugene Francis “Gene’ Fama. He was born to Angelina and Francis Fama. His grandparents were immigrants from Italy. He is honored with Malden Catholic High School Athletic Hall of Fame. He attended Tufts University and in 1960, he earned his undergraduate degree in Romance Languages magna cum laude. While he was studying at Tufts University, he was selected as the school’s outstanding student-athlete.

He earned M.B.A and Ph.D. from the Booth School of Business at the University of Chicago in economics and finance. His doctoral administrators were Nobel Prize winner Harry Roberts and Merton Miller.

CAREER & HIS CONTRIBUTIONS

He spent his whole career teaching at the University of Chicago. In January 1965, in the Journal of Business, his Ph.D. thesis was published. It was entitled “The Behavior of Stock Market Prices”. His thesis terminated that stock price movements are unforeseeable and follow a random walk. It was later written into a less technical article “Random Walks In Stock Market Prices”. It was published in 1965 in Financial Analysts Journal and in 1968 in Institutional Investor. In 1969 his article “The Adjustment of Stock Prices to New Information” was published in the International Economics Review. He also won The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel in 2013. Casually, it is called as the Nobel Prize in Economics.

Beginning with his Ph.D. thesis, He is called as the father of the efficient-market hypothesis. His article was published in the May 1970 issue of the Journal of Finance entitled “Efficient Capital Markets: A Review of Theory and Empirical Work”. In his article, he suggested two crucial concepts which define the conversation on efficient markets ever since. At first, he suggested three types of efficiency i.e. 1. Strong-form 2. Semi-strong form 3. Weak efficiency. All three efficiency is explained in the context of what information sets are caused in price trend. He then demonstrated another concept known as the “joint hypothesis problem”.

In 2005 he was awarded Deutsche bank Prize in Financial economics. He also won Morgan Stanley-American Finance Association Award in 2008. In 2013 he was awarded Nobel memorial Prize in Economics.

His thesis can be briefly studied in Wikipedia or other sites. We can find his pictures on the internet easily. His child name is Elizabeth Fama. His marriage life is not given.

Tags